How Banks Can Spot Fraud Rings Before They Form

Raptorx.ai

Thursday, May 29, 2025

Insights from the Frontlines of Financial Crime Detection

The Banking Industry’s Growing Challenge with Fraud Rings

In today’s fast-paced digital payment environment, fraud has transformed from isolated incidents into organized, adaptive criminal ecosystems. These are no longer lone wolves exploiting a single weakness, but fraud rings—coordinated networks of accounts, identities, and devices, often using advanced tools and techniques to remain undetected.

Financial institutions face rising pressure on multiple fronts:

- Speed of Transactions: With systems like UPI, AEPS, and real-time settlement, fraudulent funds can move across multiple accounts within seconds.

- Volume of Data: Millions of transactions happen daily. Human-led monitoring and static rules can’t keep up.

- Complexity of Fraud: Fraudsters are layering transactions, using synthetic identities, and taking advantage of siloed banking systems to evade detection.

- False Positives: Outdated detection engines trigger an overwhelming number of false alerts, wasting investigative resources and frustrating genuine customers.

The truth is, fraud detection today requires more than just looking at anomalies—it requires understanding behaviors, patterns, and networks.

Where Existing Systems Fall Short

While banks have made significant investments in fraud detection systems, many still rely on approaches that are reactive and rigid. Common gaps include:

Existing Engines

- Work on pre-set thresholds or logic.

- Easy for fraudsters to study and bypass.

- Don’t account for behavioral or contextual changes.

Siloed Monitoring Systems

- UPI, card, and AEPS often operate in disconnected silos.

- Investigators don’t have a holistic view of a customer or account across systems.

Limited View of Risk

- Risk is often assessed at onboarding, not continuously updated.

- Fraudsters take advantage of dormant or newly created accounts to launch attacks.

Manual Investigations

- STR (Suspicious Transaction Report) filing and fraud investigations are still largely manual.

- Compliance delays and human error expose banks to regulatory risks.

This reactive approach allows fraud rings to form and operate undetected, often only discovered after damage has been done.

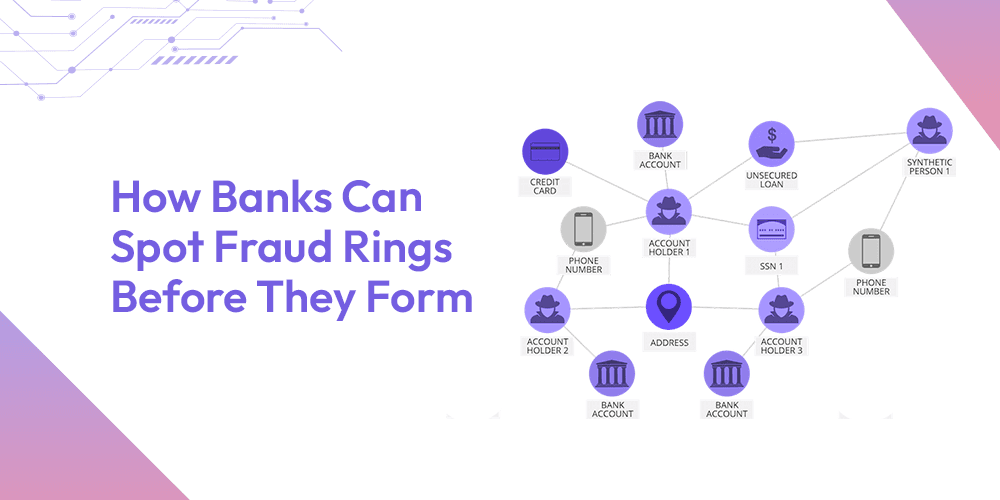

A New Lens: Understanding Fraud as a Network, Not an Event

RaptorX views fraud differently—not as isolated spikes, but as a web of behaviors and relationships. This perspective comes from years of working with banks, regulators, and digital payment systems to understand how modern fraud unfolds.

Some key learnings from the industry:

- Fraud rings form gradually, with seemingly normal accounts interacting subtly before executing a high-volume attack.

- Device, IP, and merchant overlaps are early signals of collusion.

- Behavioral shifts—like velocity spikes or frequent small transactions—signal mule activity or account takeovers.

- Accounts that lie dormant and suddenly activate often play a role in laundering.

Banks that see fraud as a network problem—not just a transactional one—are better positioned to act early and decisively.

How Financial Institutions Can Proactively Detect Fraud Rings

This evolving threat landscape requires a strategic, intelligent, and proactive approach. Here’s how banks can spot fraud rings before they mature into coordinated financial attacks:

1. Adopt a Network-Based Detection Mindset

Instead of focusing on isolated accounts, banks should:

- Map relationships across accounts, devices, geolocations, and merchants.

- Use graph-based models to detect patterns across these relationships.

- Continuously evaluate how these networks evolve over time.

Outcome: Banks begin to see emerging fraud rings as they form, often before funds are lost.

2. Continuously Monitor Lifecycle Risk

Risk isn’t static—it shifts constantly. Financial institutions should:

- Implement dynamic risk scoring that evolves with each transaction or behavior change.

- Track customer, account, and merchant behaviors—not just at onboarding but throughout their lifecycle.

Outcome: High-risk entities can be identified early, even if they have no previous fraud history.

3. Strengthen Cross-Rail Visibility

Fraud doesn’t respect channel boundaries. Banks must:

- Integrate insights across UPI, AEPS, cards, wallets, and banking systems.

- Establish a unified intelligence layer that connects the dots.

Outcome: Better visibility leads to stronger, faster responses to cross-channel fraud attempts.

4. Reduce False Positives with Contextual Intelligence

Static thresholds catch outliers, but often miss context. To avoid alert fatigue:

- Use behavioral baselines and dynamic scoring to evaluate intent, not just transaction size or speed.

- Layer in network signals to distinguish between lone anomalies and coordinated fraud activity.

Outcome: Investigators can focus on high-priority cases with confidence.

5. Automate AML and Compliance Workflows

Manual compliance processes slow response and expose banks to penalties. Institutions should:

- Automate STR generation, supported with full audit trails.

- Use pre-built case narratives and entity linkages for quicker investigations.

- Streamline suspicious case escalations with data-driven evidence.

Outcome: Up to 50% faster AML responses, fewer compliance errors, and improved regulator confidence.

What Banks Gain From This Approach

- Real-time Fraud Detection: Identify fraud rings before they cause damage.

- Smarter Investigations: Empower teams with complete context and fewer false positives.

- Faster Compliance: Meet regulatory expectations with less manual overhead.

- Operational Efficiency: Reduce investigator workload while increasing detection accuracy.

- Customer Trust: Protect accounts without causing unnecessary friction for genuine users.

Final Thought: Fraud Rings Are Getting Smarter—So Must We

Fraudsters are no longer relying on brute force—they are leveraging coordination, time, and technology. Banks must do the same. The path forward lies in recognizing that modern financial crime is not just a transaction issue—it’s a network problem.

By adopting intelligence-led frameworks rooted in relationship mapping, behavioral insight, and dynamic risk scoring, banks can move from reactive to preventive. This isn’t just a technological upgrade—it’s a strategic defense imperative for every financial institution.