Reducing False Positives in AML: How RaptorX.ai Increases Accuracy and Efficiency

RaptorX.ai

Tuesday, February 18, 2025

How RaptorX Slashes False Positives in AML Detection

False positives in Anti-Money Laundering (AML) detection are a massive headache for financial institutions. Traditional AML systems rely on rigid, one-size-fits-all thresholds that flag too many legitimate transactions as suspicious. This flood of false positives overwhelms analysts, wastes resources, and diverts attention from real financial crime.

At RaptorX, we take a different approach. Our AI-driven solution doesn’t just flag transactions—it understands complex behaviors, predicts risk, and adapts in real-time. The result? Smarter detection, fewer false positives, and a compliance team that can focus on what truly matters.

The Problem with Traditional AML Systems

Most AML frameworks still rely on static rules and thresholds. While these are necessary for basic compliance, they come with major flaws:

- Too Many Alerts: Generic thresholds trigger excessive false positives, creating operational inefficiencies and compliance fatigue.

- Lack of Context: Traditional systems can’t differentiate between normal customer activity and actual suspicious behavior.

- Manual Adjustments are Painful: Tweaking thresholds to find the right balance is time-consuming, labor-intensive, and often ineffective.

- Real Threats Get Missed: If thresholds are raised to reduce false positives, there’s a risk of overlooking actual money laundering activity.

How RaptorX Solves the False Positive Challenge

RaptorX leverages patented AI technology to refine AML detection, ensuring accuracy without the clutter of unnecessary alerts. Our system dynamically adapts to evolving risks and learns from past investigations, making compliance smarter and more efficient.

AI-Driven, Adaptive AML Thresholds

Rather than relying on static thresholds, RaptorX applies AI-driven segmentation to analyze real-time customer behavior and transaction history. This granular approach ensures that AML thresholds are tailored to specific risk profiles, reducing false alarms while maintaining strong compliance.

Continuous Learning and Self-Improvement

Our AI doesn’t just follow a fixed set of rules—it evolves. By continuously analyzing transaction patterns and case outcomes, RaptorX fine-tunes its models to better distinguish between legitimate transactions and actual financial crime. This means detection gets sharper over time, with fewer false positives and stronger fraud prevention.

Intelligent Alert Prioritization

RaptorX doesn’t just generate alerts; it prioritizes them. Our AI assesses risk in real-time, ensuring that high-risk transactions get immediate attention while filtering out noise. Compliance teams can focus on genuine threats instead of drowning in unnecessary reviews.

Seamless Integration with Existing AML Systems

Switching to AI-driven AML shouldn’t mean tearing out your existing infrastructure. RaptorX integrates seamlessly with legacy AML frameworks, enhancing detection without disrupting workflows. Thus, financial institutions can effortlessly transition to smarter compliance.

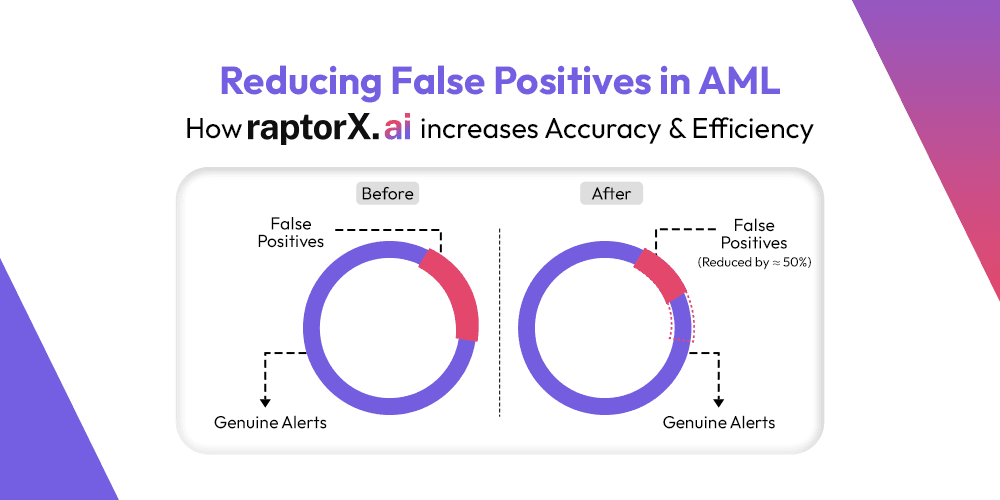

The RaptorX Impact: Smarter, Faster, and More Efficient AML Compliance

Financial institutions using RaptorX experience tangible benefits:

- Up to 60% Reduction in False Positives: Less wasted time, more focus on real threats.

- Faster Investigations: AML case resolution accelerates 10X, cutting review time from days to minutes.

- Lower Compliance Costs: Automation reduces manual effort by 50-70%, saving institutions millions.

- Regulatory Confidence: With explainable AI and transparent decision-making, compliance teams can confidently defend their findings.

The Future of AML Compliance is AI-Driven

As financial crime tactics become more sophisticated, outdated AML systems won’t cut it. Institutions need proactive, intelligent, and continuously improving technology. RaptorX is leading this transformation, providing an AI-powered compliance solution that reduces false positives, enhances risk detection, and helps financial institutions stay ahead of evolving threats.

Say goodbye to alert fatigue and hello to smarter AML compliance with RaptorX.